A Forum for leveraging geoeconomics in business, trade, and investments.

This esteemed geoeconomics forum stands as a premier platform for transformative discussions, knowledge expansion, and the development of innovative frameworks and strategies focused on Value and Impact investments that are poised to reshape our world. By empowering investors, entrepreneurs, CXOs, financial managers, diplomats, and policymakers, it equips them to adeptly navigate the dynamic geoeconomic landscape and seize its abundant opportunities with confidence.

In today’s rapidly changing landscape, economics is often sidelined in investment strategies, primarily managed by government entities, consultants, and advisors. However, leaders from both the public and private sectors are awakening to the fact that their geopolitical strategies are outdated. Factors such as deglobalization, the transformation of global order, the breakdown of treaties, and the renegotiation of trade deals are reshaping the way we think about investment. Global projects and corporations now face critical challenges in navigating survival and growth in this complex environment, particularly in accessing real-world assets and addressing legal issues within financial accounting systems. These issues are vital for enabling seamless value transfer across borders. This event offers a unique opportunity to gain essential insights into the geoeconomics of investing in our increasingly digital world. The Forum provides opportunities through,

A weekly online discussion forum

Global seminars and conferences.

An Investment Club for the members

Podcasts and Newsletters

GeoEconomics Body of Knowledge

Research Publications

One Day Boot Camp!

Learn, Network and Find Opportunities!

Why Join the Forum?

Global economies, alongside their private and public sectors, are currently facing formidable challenges as they strive for sustainability and growth in an increasingly intricate landscape. This forum stands as a crucial platform for participants to delve into the complex realm of geoeconomics and uncover its profound implications for investing in our swiftly digitizing world.

For investors and financial capital allocators, the ability to navigate a marketplace filled with superficial and poorly conceived projects is essential. While many believe that financial capital liquidity can alleviate risk, the reality often reveals that such shallow investments fail to deliver sustainable returns. This lack of sustainability stems from capital flows that do not complete the vital cycle of generating inherent value through impactful projects—essential for building robust, long-term assets.

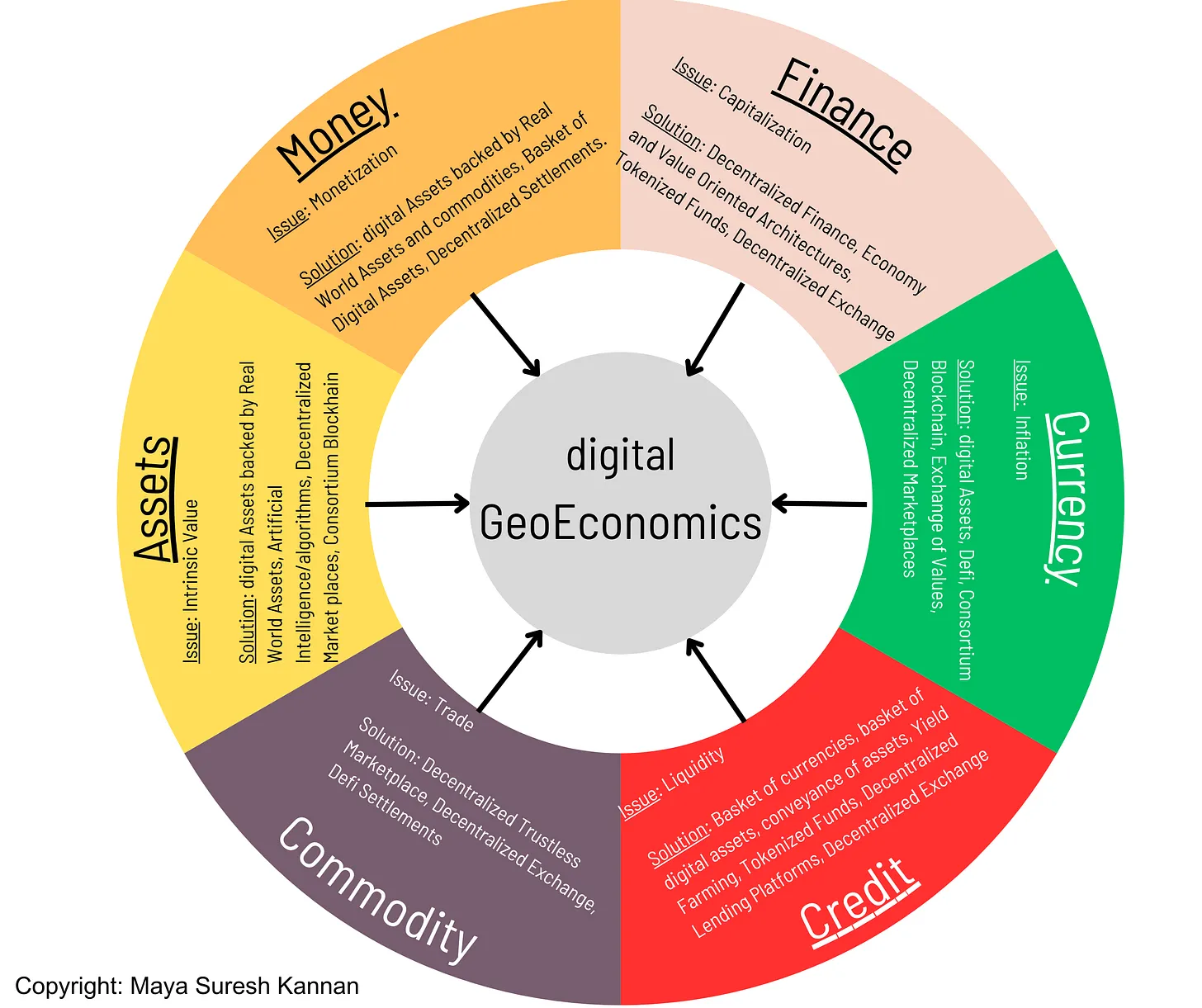

At this forum, participants will gain insights on how to strategically invest in Impact and Value Projects backed by sophisticated geoeconomic strategies and tools. In an era where countries are forging strategic alliances to create new economic blocs, we are witnessing the emergence of innovative currencies rooted in digital and cryptographic trust.

In this transformative phase, a significant yet frequently overlooked trend is the rise of a new category of tradable liquid assets. Visionary companies are at the forefront, harnessing advanced artificial intelligence and cutting-edge algorithms to offer unique intrinsic values and technological advantages, empowering them to outperform their rivals significantly.

This forum is meticulously designed to equip participants with a comprehensive understanding of geoeconomics, furnishing them with actionable strategies that can be seamlessly incorporated into both traditional and digital investment frameworks. An esteemed panel of industry leaders will explore critical geoeconomic regulatory issues, covering vital topics such as investment screening processes, access to private assets, asset privatization mechanisms, the importance of golden shares, foreign direct investment considerations, and the complexities of banking governance. This forum promises to be an invaluable resource for anyone seeking to excel in the dynamic landscape of global investments. Various Topics of discussion in the forum include, but are not limited to,

Impact- Value as a Two-Tier System

Structuring PPP, SPV, ETF, & Token Funds

Liquidity and settlement of modern assets.

Innovative Champion Organizations.

Alternative Investments and Sovereign Funds

Wealth building from emerging markets.

Investment Screening in the New World

Era of multilateral assets and currencies

Intrinsic value AI & digital Geoeconomics.

Intrinsic value through AI and digital Assets

Corporate Geoeconomics

Access to global Private assets and IPs

Message from the Chief Convenor

Geoeconomics is emerging as a significant force in shaping and reconfiguring global political systems. Individual sovereign nations and key institutions now have more at stake than ever before. We are moving toward a world where a larger group of stakeholders has a vested interest in global dynamics. To thrive in this transformed landscape, it is essential to understand that new economic, financial, risk, legal, and trade frameworks are developing. Mayanomics serves as one such blueprint for navigating these changes. I have put together this Forum as a platform for advancing those geoeconomic principles, frameworks, methodologies, and tools to Impact and Value investments across various sectors and industries in both public and private domains.

The global shift towards a new economic order is becoming unmistakable as nations prepare for profound changes. Countries are forming strategic alliances to create new economic blocs, paving the way for innovative currencies built on digital and cryptographic trust.

In this transformative era, a significant yet often overlooked development is the rise of a new category of tradable liquid assets. These assets, spearheaded by forward-thinking companies that harness artificial intelligence and advanced algorithms, offer unique intrinsic values and technological advantages, enabling them to outpace their competitors significantly.

Maya Suresh Kannan

( Chief Convenor )

CATEGORY

Our Top Investment Committees

mayaNomics Forum runs various committees across many Sectors of Investments and Developments

Energy

Learn More

Science & Tech

Learn More

Artificial Intelligence

Learn More

Agriculture

Learn More

COURCES

Recent Committee Discussions

CALL TO ACTION

Ready To Join the Forum ! Let’s Have a Talk.

TOP FACILITY

Check out Our Collaboration Platform

01

01

Investment Club & Focus groups

MayaNomics Club is a vibrant community of investors dedicated to the principles of learning, sharing, and cultivating wealth through informed, collaborative investing strategies. Our members range from complete beginners eager to understand the basics of investment to seasoned investors looking to refine their skills and expand their portfolios. The club offers a variety of resources, including expert-led workshops, interactive discussions, and a supportive online platform where members can exchange insights and experiences. By fostering an environment of collaboration, we empower each member to enhance their financial literacy, make informed investment choices, and achieve their financial goals—together. Join us to explore new investment opportunities and navigate the complexities of the financial world as a united group.

Learn More

02

02

Books, Resources & Publications

As a member of our platform, you have access to a vast collection of books, scholarly articles, and various publications across multiple disciplines. In addition to reading and researching, you can utilize this platform to publish your own creative works, including articles, research papers, and other scholarly documents. Our platform also facilitates collaboration by allowing you to find co-authors who share your interests and expertise. Engage in peer review processes to refine your work and provide constructive feedback to others. Participate in collaborative activities and discussions on specialized topics, fostering a community of knowledge-sharing and intellectual growth. Whether you’re a seasoned researcher or just starting out, our platform supports your academic and creative endeavors every step of the way.

Learn More

03

03

Task Forces & Committees

Create, manage, and operationalize a range of specialized task forces, focus groups, and committees to address specific goals and initiatives. Ensure that each group is composed of relevant stakeholders and experts, and outline clear objectives, action plans, and timelines for their work. Facilitate regular meetings and communication among members to track progress, share insights, and make necessary adjustments to enhance effectiveness. Various topics, resources, and skill areas of such collaboration include digital geoeconomics, frameworks, Strategic guidelines, international laws of geoeconomics, access to assets, Corporate Geoeconomics, digital Assets, Cause-Level Agreements, Investment Screening, Artificial Intelligence, and value-oriented architecture.

Learn More

TESTIMONIAL

Subscribe Our Newsletter For Latest Updates !

Useful Links

About us

Careers

News & Articles

Legal Notice

Support

About us

Contact Us

FAQ

Contact Us

Ph: +41 447981036

Membership: membership@mayanomics.org

Events: events@mayanomics.org

PR & Partnerships: pr@mayanomics.org

Governance/Board: governance@mayanomics.org

Member Support: support@mayanomics.org

e